Tata Focused Equity Fund is an open ended equity scheme investing in maximum 30 stocks across market capitalization (i.e. multicap).

The Fund aims to generate returns by investing in stocks with long runways for growth regardless of market capitalization or sector. With a bottom up stock picking approach, the fund aims to carefully analyze and invest in compounding stocks following the GARP-Growth At Reasonable Price philosophy.

Aim for long term capital growth

Concentrated equity portfolio limited to a maximum of 30 stocks

Invest across market capitalization and sectors

Bottom up approach to select compounding stocks

Conviction ideas backed by meaningful allocations

Compounding stocks

Sector Agnostic

Market Cap Agnostic

Low Churn

| Scheme Name | Tata Focused Equity Fund |

| Investment Objective | The investment objective of the scheme is to generate long term capital

appreciation by investing in equity & equity related instruments of maximum

30 stocks across market caps. However, there is no assurance or guarantee that the investment objective of the Scheme will be achieved. The scheme does not assure or guarantee any returns. |

| Type of Scheme | An Open Ended Equity Scheme investing in maximum 30 stocks across market caps (i.e multicap). |

| Fund Manager | Meeta Shetty & Arvindkumar Chetty |

| Benchmark | Nifty 500 TRI |

| Min. Investment Amounts | Rs. 5,000/- and in multiple of Re.1/- thereafter. Additional Investment: Rs 1,000/- and in multiple of Re 1/- thereafter. |

| Load Structure |

Entry Load: N.A. Exit Load:

|

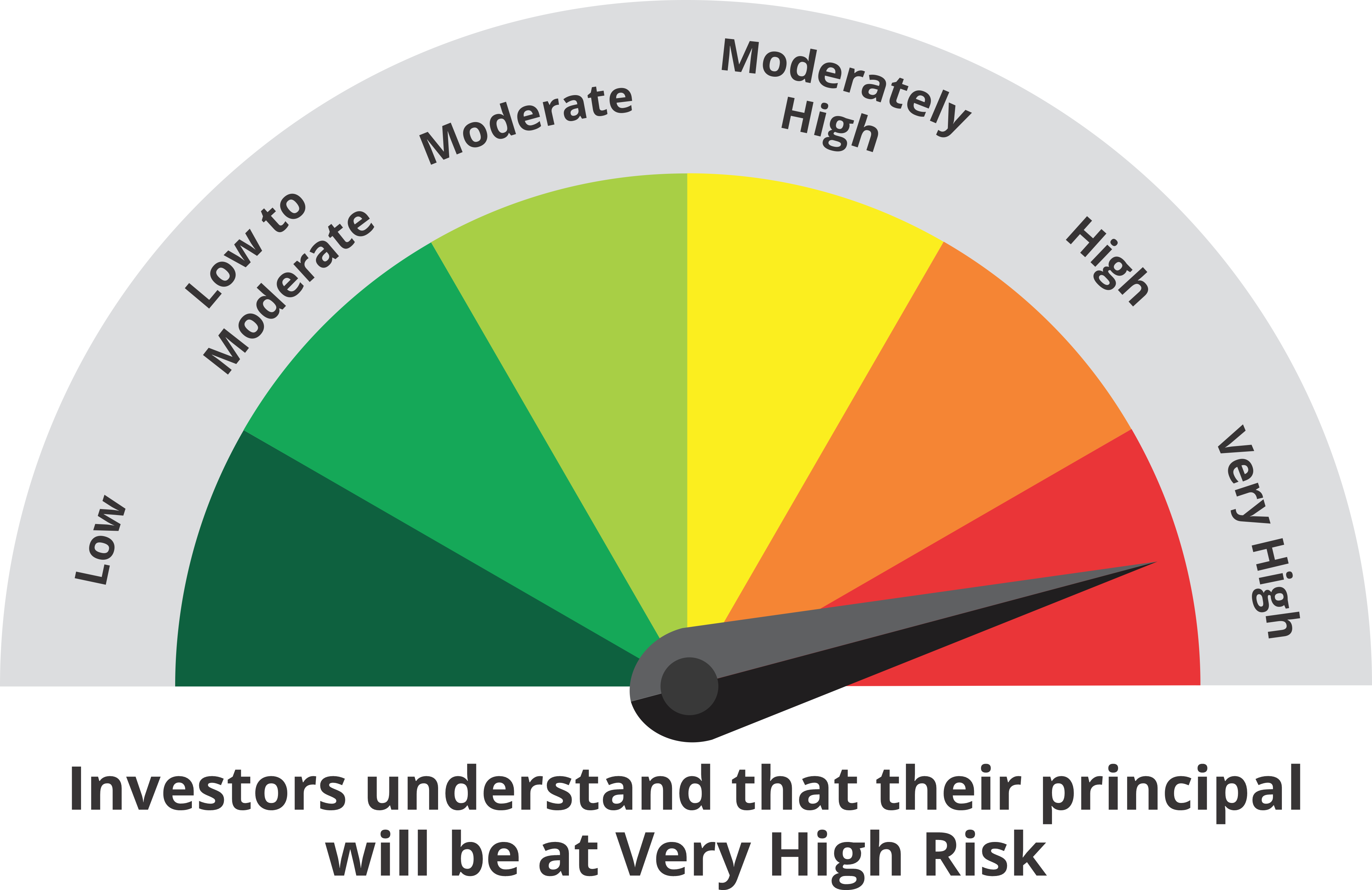

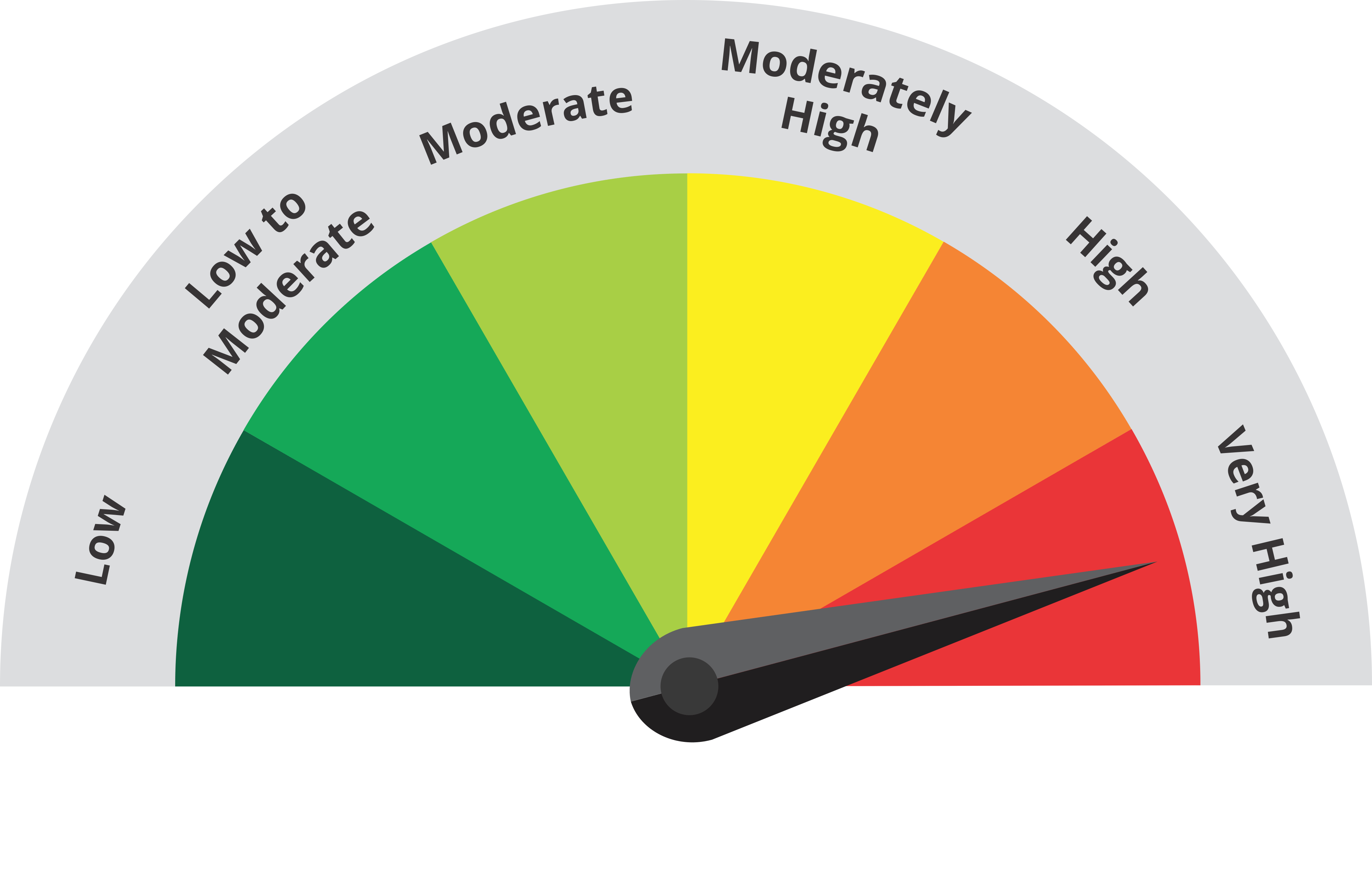

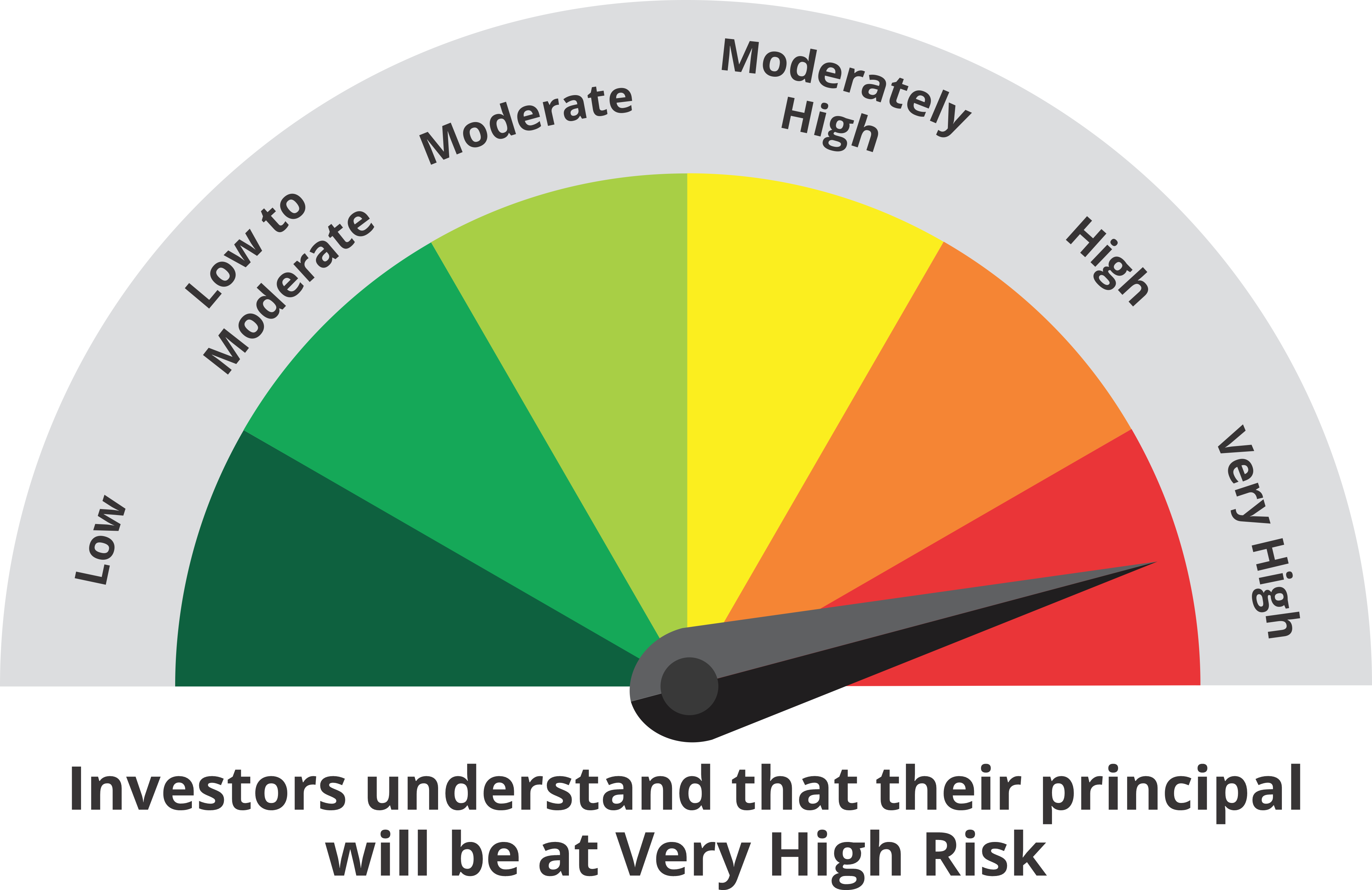

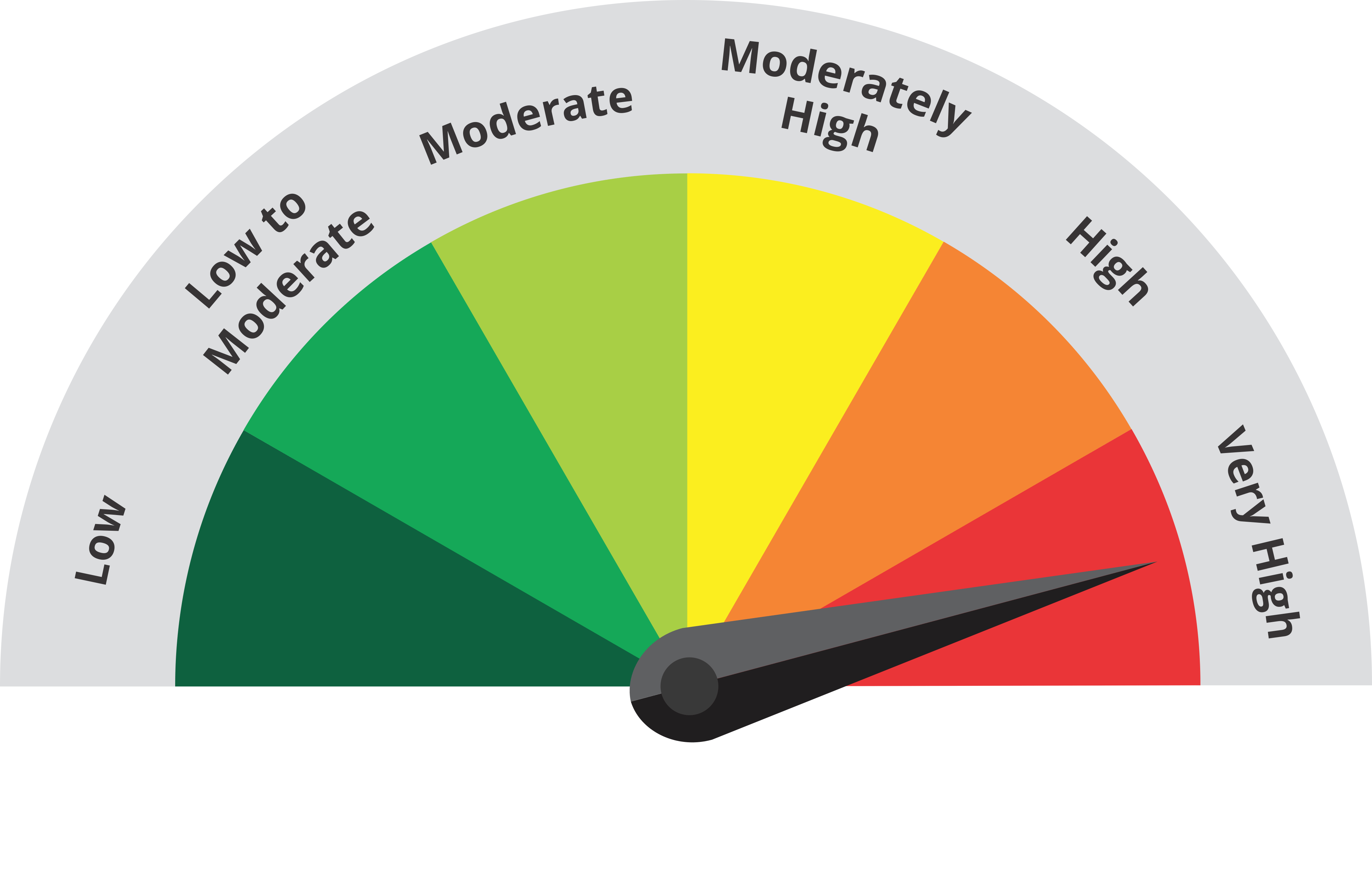

| Product Label | TATA Focused Equity Fund | Nifty 500 TRI |

|---|---|---|

|

This product is suitable for investors who are seeking*:

*Investors should consult their financial advisors if in doubt about |

|

|

This product is suitable for investors who are seeking*:

*Investors should consult their financial advisors if in doubt about

(It may be noted that risk-o-meter specified above is based on the schema characteristics. The same shall be udpated in accordance with provisions of SEBI circular dated october 5, 2020 on product labelling in mutual fund schemes on ongoing basis)

Corporate Office Address:

Tata Asset Management Private Limited, 19th floor, Parinee Crescenzo, ‘G’ Block, Bandra Kurla Complex, Opposite MCA Club, Bandra (E), Mumbai – 400051

Mutual fund investments are subject to market risks, read all scheme related documents carefully.